Summary

-

Over the past week, the protocol’s volume increased by 29.94%, averaging $1.2B per day, compared to $898.1M on average in the three weeks prior.

-

In the same span, SOL’s price decreased by 28.94%, ETH’s price decreased by 19.99%, and BTC’s price decreased by 14.50%. JLP decreased by 10.29% vs. the JLP basket’s 17.25% decrease, representing an outperformance of 6.96% for LPs relative to the JLP pool’s underlying assets.

-

Jupiter traders’ aggregate realized PnL decreased by $9.5M in gross terms and decreased by $19.2M in net terms due to their long-favored exposure. Traders’ cumulative unrealized PnLs, meanwhile, decreased by $56.0M this week.

Protocol level

JLP pool

The JLP pool held relatively steady in token unit terms this week.

The pool’s composition also hemmed close to target, with utilization rates rising to as high as 36% for WBTC.

JLP Market Comparison

JLP’s market price decreased by 10.29% over the last week. In the same period, BTC decreased by 14.50%, ETH decreased by 19.99%, and SOL decreased by 28.94%.

Given the JLP pool’s weights:

-

SOL - 45.65%

-

WBTC - 14.16%

-

WETH - 9.92%

-

USDC - 26.43%

-

USDT - 3.82%

JLP’s basket price decreased by 17.25%, reflecting an outperformance of 6.96% for LPs due to the long-skewed imbalance of open interest.

Volume

Volume increased by 29.94% on Jupiter in the past week compared to previous weeks, averaging $1.2B per day, compared to $898.1M on average in the three weeks prior. BTC’s average daily volume increased by 87.95% over the last week compared to the three weeks prior.

SOL continues to be the most dominant market on Jupiter, consisting of 60.44% of the protocol volume in the last week.

Unique daily users

Jupiter’s perps exchange has served a maximum of ~10,000 unique addresses on its most active days last week. Recently, it has served between 3,000 and 9,000 addresses per day.

PnL

Due to Jupiter traders’ net long exposure, their aggregate realized PnL decreased by $9.5M in gross terms and decreased by $19.2M after accounting for fees. Traders’ cumulative unrealized PnLs, meanwhile, decreased by $56.0M this week.

Fees

Over the past week, Jupiter’s cumulative fees were ~$6.7M, with a daily average of $959.1K, a decrease of 27.67% from $1.3M the previous three weeks.

Market Level

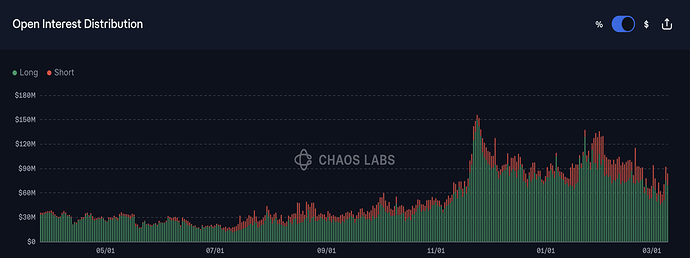

OI distribution

Jupiter’s traders continue to have a strong bias for long positions. There’s currently no expectation or reason for that to change.

SOL:

BTC:

ETH:

Price impact

P99 trades by position size have paid 8.0 bps in the SOL market over the last four weeks, while BTC and ETH markets have paid 7.06 and 6.53 bps, respectively. P95 and below trades by size have paid less than 1 basis point above 6 bps, the base rate, in all markets.

SOL:

BTC:

ETH: