Summary

-

Over the past week, the protocol’s volume decreased by 35.25%, averaging $574.0M per day, compared to $886.4M on average in the three weeks prior.

-

In the same span, SOL’s price increased by 6.09%, ETH’s price decreased by 2.35%, and BTC’s price increased by 0.61%. JLP increased by 1.45% vs. the JLP basket’s 2.74% increase, representing a small impermanent loss of 1.29% relative to the JLP pool’s underlying assets.

-

Jupiter traders’ aggregate realized PnL increased by $1.0M in gross terms and decreased by $3.2M in net terms due to their long-favored exposure. Traders’ cumulative unrealized PnLs, meanwhile, increased by $6.4M this week.

Protocol level

JLP pool

The JLP pool held relatively steady in nominal terms this week, with WBTC declining as it trended back towards target.

The pool’s utilization rates also remained steady.

JLP Market Comparison

JLP’s market price increased by 1.45% over the last week. In the same period, BTC increased by 0.61%, ETH decreased by 2.35%, and SOL increased by 6.09%.

Given the JLP pool’s weights:

-

SOL - 47.2%

-

WBTC - 13.31%

-

WETH - 9.32%

-

USDC - 26.35%

-

USDT - 3.78%

JLP’s basket price increased by 2.74%, reflecting an impermanent loss of 1.29% for LPs due to the long-skewed imbalance of open interest.

Volume

Volume decreased by 35.25% on Jupiter in the past week compared to previous weeks, averaging $574.0M per day, compared to $886.4M on average in the three weeks prior. BTC’s average daily volume decreased by 46.1% over the last week compared to the three weeks prior.

SOL continues to be the most dominant market on Jupiter, consisting of 67.30% of the protocol volume in the last week.

Unique daily users

Jupiter’s perps exchange has served a maximum of ~15,000 unique addresses on its most active days. Recently, it has served between 3,000 and 8,000 addresses per day.

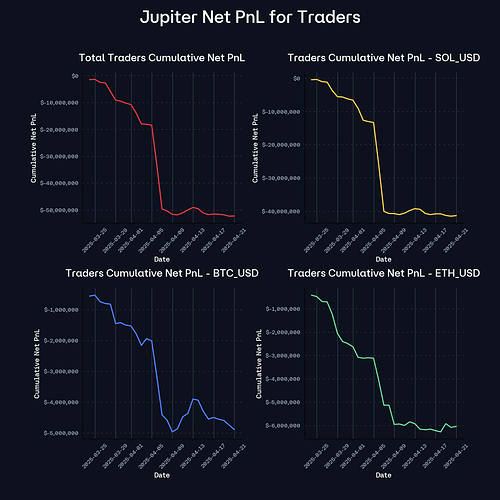

PnL

Due to Jupiter traders’ net long exposure, their aggregate realized PnL increased by $1.0M in gross terms but decreased by $3.2M after accounting for fees. Traders’ cumulative unrealized PnLs, meanwhile, increased by $6.4M this week.

Fees

Over the past week, Jupiter’s cumulative fees were ~$3.3M, with a daily average of $472.2K.

Market Level

OI distribution

Jupiter’s traders continue to have a strong bias for long positions. There’s currently no expectation or reason for that to change.

SOL:

BTC:

ETH: